What You Need to Know When Trading Gold in Indian Markets

Tapping into profitable markets is an essential part of diversifying your gold portfolio. Since gold is as old as man, there are various commodity exchanges that you can invest in if you want to go beyond your local reach.

The Indian commodity market offers one of the best places to conduct business with gold assets. China and India are neck and neck when it comes to being the world’s largest gold consumers. You should realise its spot in the global gold market if you want to understand why India is a viable place to invest your gold futures trading.

Understanding Rs to $ gold conversions

The global spot price for gold can translate to 1 Troy Ounce or 31.1035 grams of gold. This equates to an exchange rate of Rs.66/$ or Rs.83,086.08 for every 31.1035 grams of gold. When dealing with gold futures trading, the unit of measurement is the value for every 10 grams or Rs.26,712/10 grams.

Before you invest in the Indian market, you should also consider import duty on gold, together with back charges and insurance costs will add up to India’s spot price in rupee values. Depending on domestic demand and supply of gold, you should expect seasonal fluctuations of the actual value.

Choosing between different Indian gold commodity contracts

There are six monthly gold commodity contracts available for trading at any point in time in Indian commodity markets. Gold futures contracts expire on the 5th of every calendar month in the form of a Big Gold contract lot sizes that are 1 kilogram large with a notional value of Rs.3.1 million. It’s a relatively safe gold investment with a SPAN margin of 4% and an extreme loss at 1%. The factors affecting the low margins are mainly due to the volatility of gold prices.

Although 1 kilogram is a substantial amount, there are subsets of gold futures contracts available in smaller lot sizes. For example, a Gold Mini contract has a lot size of just 100 grams. Also, an even smaller lot size of 8 grams is available through a Gold Guinea contract.

Settling your gold contract

It’s typical to perform physical gold deliveries for contracts. However, if you’re the seller, you have to give serially numbered gold bars supplied through LBMA-approved conditions. This requires you to be an approved supplier under their name. Your delivery should also include 995-purity. Your potential buyer won’t accept it if your gold lot is any lower. However, if you offer a 999-purity delivery, you can get a premium credit for a higher grade.

If you can’t deliver a physical delivery of your gold assets, you can square off your position instead. Since the gold contract’s settlement is on the 5th of every month, you need to give a non-delivery notice while squaring off your positioning at least four days before the settlement date.

Conclusion

The world’s largest central banks contain a considerable amount of their forex reserves through gold assets. Once the US’s Richard Nixon abandoned the gold standard in 1971, gold became a stellar backing currency. This set the stage for gold to become one of the most profitable investments to this day.

Diversifying your portfolio won’t matter unless you know when and where it’s best to cash out your gold assets. Choosing Indian commodity markets is one potential avenue where you can trade your gold to receive a considerable payout for your investment.

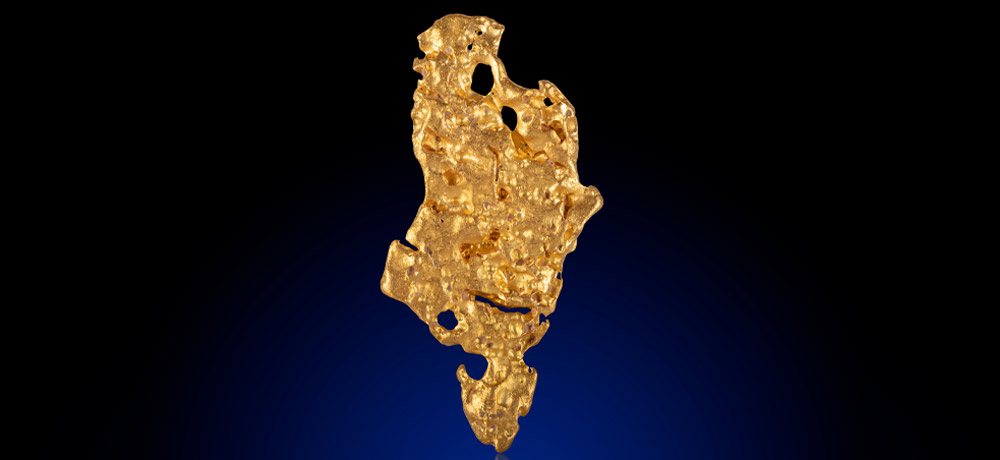

Before you’re ready to deal with the international market, you should first know how to build up your portfolio through local sources. If you want to buy gold in Australia, we at Gold Nugget Shop can provide you with a secure network to buy from different gold sellers. Sign up with us today to discover how you can make a golden investment opportunity!